At its annual general meeting, scheduled for Oct. 16 at 3 p.m. at Cinecenta, the UVSS will ask undergraduates to choose whether or not to hold a referendum on the issue of fossil fuel divestment next year, an action meant to formalize the undergraduate population’s beliefs on the issue. More specifically, the following yes or no question will be posed at the UVSS Annual General Meeting:

[Be it resolved that] the membership approve the following question go to a referendum, to be scheduled for March 2–3, 2015 and held in conjunction with UVSS elections to the Board of Directors:

Do you support the UVSS lobbying the University of Victoria Foundation to withdraw (or “divest”) its direct investments in fossil fuel companies and re-invest the proceeds in the most financially and socially responsible alternative investments?

In response, the Martlet has created a handy FAQ to better inform students before they attend the AGM.

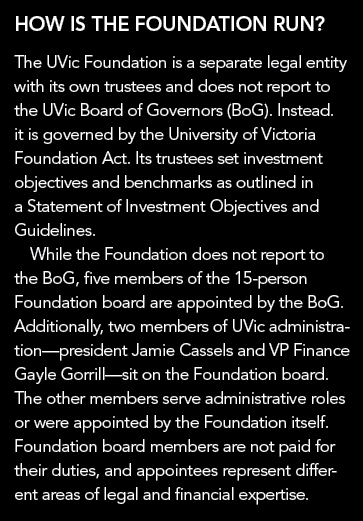

What is the UVic Foundation?

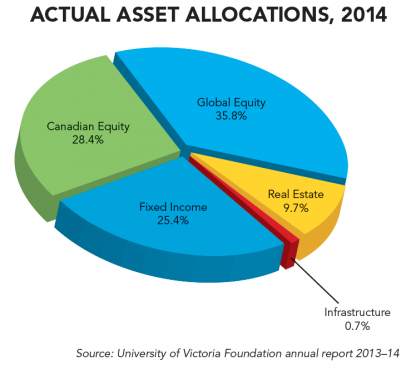

The UVic Foundation manages the university’s endowment, which is worth approximately $356 million. According to its 2014 annual report, it disburses $12.8 million annually for scholarships, bursaries, and other university purposes. It is separate from the university’s pension plans.

What’s the issue?

The UVic Foundation’s investment portfolio contains fossil fuel-related firms with a market value of $30.4 million as of March 31, 2014. These companies derive the majority of their revenue through the extraction, sale, or distribution of fossil fuels (coal, oil, and natural gas).

The $30.4 million figure includes oilfield service firms and oil pipeline manufacturers, but excludes companies like CN Rail, which transports fossil fuels along with other products. The figure also excludes fossil fuel investments within the Foundation’s pooled investment holdings, which are not the target of the potential referendum.

What is Divest UVic and what is their position?

Peter Gibbs, a member of Divest UVic, describes the organization as a “group of students allied with staff and facility who have a problem with [those investments].” They object on ethical and financial grounds, as outlined in a letter to the UVic Board of Governors.

Ethically, Divest UVic believes the Foundation’s fossil fuel investments are “inconsistent with UVic’s core values of sustainability, civic engagement, and innovation,” and that many people, especially First Nations communities, the Inuit, and those in the Global South, are negatively impacted by fossil fuel extraction.

Financially, they believe that fossil fuel holdings will decrease sharply in value over the long term due to their role in climate change, particularly as fossil fuel demand decreases due to tightening climate regulations. This belief, based on stranded asset theory, posits that much of the world’s fossil fuel reserves will have to remain underground if lawmakers wish to keep the anticipated average global temperature increase below 2°C this century, rendering them unexploitable and thus worthless.

Divest UVic, therefore, wants the Foundation to immediately halt all new investments in fossil fuels and divest their fossil fuel-related assets over the next three years. The grace period is intended to reduce or eliminate the short-term negative impact on the endowment.

What’s happened so far?

In May 2014, Divest UVic sent a request to the UVic Foundation, outlining their views on the fossil fuel investment, as well as a petition with 1 850 signatures.

In their response, the Foundation said that while they already follow a responsible investment style as laid out by existing Environmental, Social and Corporate Governance practices (ESG), Divest UVic’s request goes beyond those practices. The foundation did ask their investment managers to examine the viability of excluding the top 200 fossil fuel companies from further investments, but ultimately, investment managers concluded that fossil fuel divestment would not be possible without negatively impacting the endowment, hampering the fund’s ability to meet its current investment benchmarks.

In a phone interview, treasurer Andrew Coward said the Foundation first examined divestment in 2012, but revisited the issue when Divest UVic submitted its proposal. He said the Foundation treated the request with “openness and consideration,” but in addition to lower returns, managers also informed him that divestment would preclude any engagement with companies about their environmental and social responsibilities.

Since Divest UVic’s proposal, Coward said the Foundation has revisited its ESG policies, and will request their fund managers to report annually on how they are engaging with companies regarding their ESG practices. UVic will also sign onto the UN’s Principles of Responsible Investing, becoming the third university in Canada to do so.

Would divestment actually make a difference?

Perhaps. The Smith School at Oxford University studied the fossil fuel divestment movement, particularly the concept of stranded assets, and concluded that divestment would do little to directly impact the finances of oil and gas companies, as divested holdings would likely be acquired by neutral shareholders who do not share the same ethical qualms, but that the added stigma of a mass divestment campaign would harm firms in the longer term. The study did note that coal companies were more vulnerable to divestment than oil and gas companies, as there are fewer alternate investors to acquire the divested shares.

In addition, divestment could lead to changes in legislation, increasing regulatory burdens on fossil fuel companies. Finally, the report concluded that the stigma would “likely change market norms. For example, negative screens or passive funds that exclude fossil fuel companies will quickly emerge. Some banks, particularly multilateral institutions such as the World Bank, may stop lending to fossil fuel companies, particularly coal.”

What have other universities and organizations done in response to divestment campaigns?

The fossil fuel divestment movement is active on many university campuses in North America. While many larger universities (most notably Harvard) have rebuffed divestment, believing that the fund should not be used to impel social or political change, others have compromised, and smaller universities have committed to divest their endowments from fossil fuels. Stanford has committed to divest from coal, and a slew of smaller liberal arts colleges have committed to divest. So far, no Canadian universities have committed to divestment, but a referendum at UBC showed that 77 per cent of undergraduates supported divestment, leading their endowment managers to consider environmental impact when investing. However, UBC stopped short of divesting from fossil fuels.

Is it a symbolic gesture?

The referendum in question will not ask the Foundation to divest, but will simply make a public statement on whether or not students want UVic to divest. “The referendum vote is designed to put the students position on record,” says Gibbs. “The UVSS doesn’t have official authority over the endowment fund, but no university has divested from fossil fuels without significant student pressure,” like in the case of the UBC referendum. “Student support for the referendum isn’t enough, but it is a prerequisite for change. That’s not the end of our campaign, but it is our next step.”

A version of this article was published on page 3 under the headline “Everything you need to know about divestment” on Oct. 9, 2014.

For more information on the UVic Foundation, including its direct investments, annual report, and policies, click here.