Why is it important for students to file their taxes?

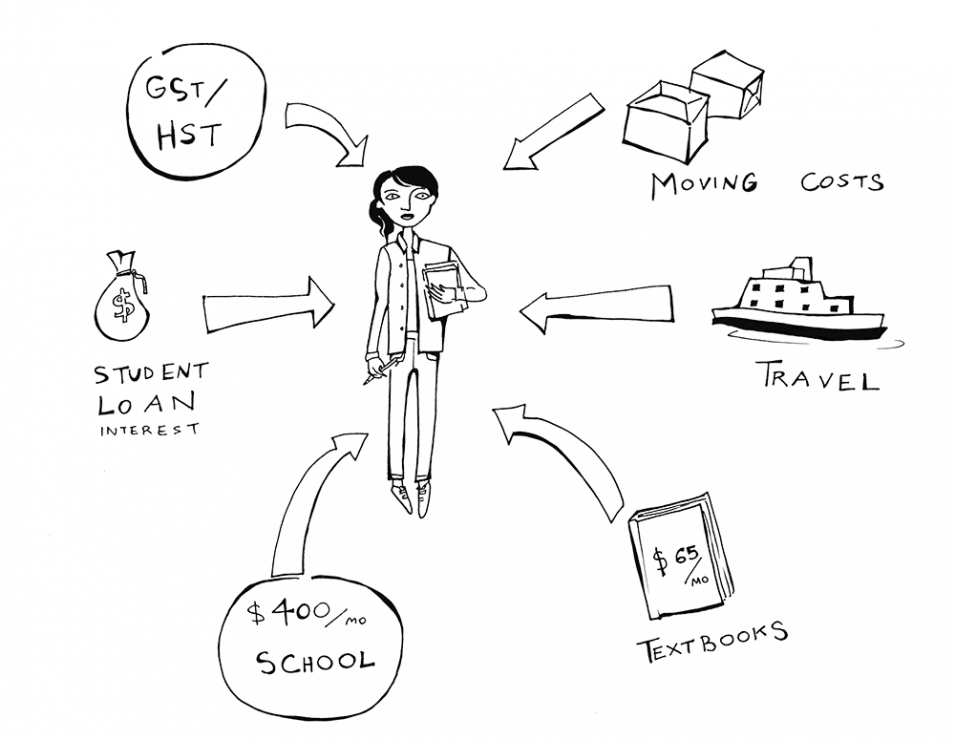

Depending on their circumstances, students may have access to various credits and benefits that will be useful for future tax situations. A student is eligible to claim an education tax credit, textbook credit, moving expenses, child care expenses, and more.

Avoiding your taxes is not the best option. According to Colette Turgeon, the Canada Revenue Agency’s Pacific Region Communications Officer, a late-filing penalty will apply for taxes filed after April 30.

“The penalty is 5 per cent of your balance owing, plus 1 per cent of your balance owing for each full month that your return is late, to a maximum of 12 months,” she said via email. “File and pay on time to avoid penalties and interest and to take advantage of tax deductions and credits available to you.”

Education tax credit and textbooks

The education tax credit allows full-time students, and part-time students with a disability or certified mental or physical impairment, to claim $400 for each month enrolled in an educational institution.

These students also qualify to claim $65 per month of classes for textbook credit. Likewise, part-time students may claim $120 per month for education, and $20 per month for textbooks.

Unless the student owes the CRA, these accumulated educational tax credits are not immediately refunded, but remain available to pay off future taxes.

Student loans

Students may claim interest paid from loans during the 2014 year, or even over the last five years if the interest has not yet been claimed. However, you may only claim interest paid from provincial or territorial legislation for post-secondary education. The legislation includes the Canada Student Loans Act and the Canada Student Financial Assistance Act.

Public transit and moving expenses

Hold on to your passes from buses, ferries, subways, etc., and apply them towards your owing taxes. These passes must include the ability for unlimited travel within five consecutive days, or an accumulated 20 days of unlimited travel within a 28-day period. UVic B.C. Transit bus passes included in your tuition fees do not apply to this category, however, and are included in your tuition form.

Moving at least 40 kilometres closer to a new post-secondary school or work qualifies you to claim moving expenses. As a post-secondary student, you can only deduct these expenses from the part of your form for scholarships, fellowships, grants, etc.

GST/HST and Direct Deposit

The goods and services tax/harmonized sales tax credit (GST/HST) is automatically calculated and sent quarterly, depending on your income tax. Typically, if you are 19 years of age or older, earn a low to modest income, and reside in Canada, you will be eligible to receive the GST/HST credit.

Canada is working towards eliminating cheques by April 2016, giving you another year to sign up for direct deposit through the CRA. Instead of by mail, you will receive your tax refund and GST/HST credit electronically to your account.

International Students

International students must first determine their residency status, and may be eligible for GST/HST credit payments. According to the CRA, you may owe taxes to the Canadian government, depending on the situation. International students must submit their income tax and benefit return to the CRA’s International and Ottawa Tax Services Office. Non-resident inquiries can be made at 1-800-959-8281.

Common Tax Mistakes

Tax filings are consistently audited and monitored — minor errors can set you behind in time and money. According to findings in the last year, individuals most often claim expenses they are not eligible to claim. If you are filing your taxes yourself, make sure to provide official receipts, especially for categories like moving expenses, student loans, and tuition/education.

Filing your taxes

The first step is documentation collection. Collect your receipts, passes, and official forms before filing your taxes. A student will typically have tax forms from the university (available through UVic MyPage), and employment T4 forms, which must be provided to you from your employer by law.

There are many resources available for filing your yearly taxes. The CRA offers their own online service, NETFILE, which allows you to file your taxes using one of their certified software programs. These include TurboTax, StudioTax, etc.

The Community Volunteer Income Tax Program (CVITP) offers clinics to help with simple tax returns, and is recommended for those claiming child care expenses. H&R Block provides free online filing software, and also local offices to file your taxes at a student rate of $39.99. However, due to recent policy change, if you are claiming investments or expenses beyond tuition and part-time work, the student price will not apply.